In a study forthcoming in Real Estate Economics, Kahshin Leow and Thies Lindenthal explore how machine learning (ML) techniques can partially predict the returns of Real Estate Investment Trusts (REITs). Their findings reveal that ML models significantly outperform traditional regression techniques, presenting opportunities for investors seeking better market timing and portfolio allocations.

Key Findings

- Machine Learning Beats Traditional Models

- Traditional ordinary least squares (OLS) models fail to capture complex interactions in REIT return prediction. Expanding the OLS model with over 800 predictors leads to poor performance, whereas ML models thrive with high-dimensional data.

- Principal Component Regression (PCR) improves predictability slightly, but advanced ML techniques like LASSO, Elastic Net (ENet), regression trees, and neural networks (NNs) provide much stronger results.

- REIT Returns Are More Predictable Than Stocks

- Contrary to prior research, REITs exhibit significantly higher predictability than stocks, with ML models achieving up to 12 times greater predictive accuracy.

- Regression tree models and neural networks perform exceptionally well, with the best-performing neural network (NN1) achieving an out-of-sample R² of 5.01%, compared to 0.40% for the best stock market models.

- The predictability has faded since ~2015, coinciding with the proliferation of ML models and strategies in the industry. In efficient markets, one would expect an arms race in which investors seek an edge from ever-improving data and algorithms.

- Predictability Varies by REIT Type

- Large REITs are more predictable than smaller ones.

- Sector specialization enhances predictability, with retail, healthcare, and residential REITs showing higher forecast accuracy than diversified REITs.

- ML Models Adapt to Market Conditions

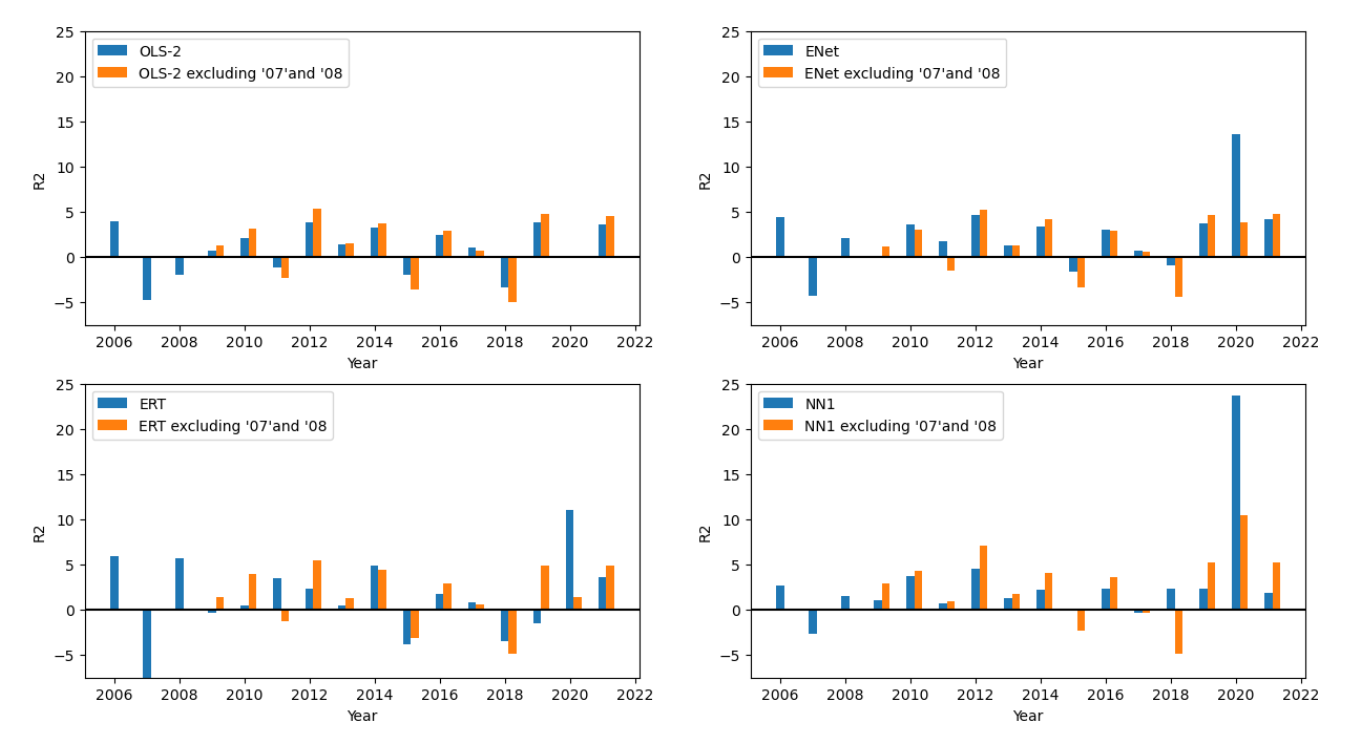

- ML models successfully learn from past crises. While they struggled during the 2007–2008 financial crisis, they performed exceptionally well in 2020, likely due to their ability to recognize and adapt to market downturn patterns.

Figure 1: Out-of-sample predictive R2, by year. The blue bars in this figure show the monthly out-of-sample predictive R2, averaged by calendar year, for OLS-2 and our top machine learning models (ENet, ERT and NN1) during the test period from 2006 through 2021. The orange bars display the out-of-sample predictive R2 for each model averaged by calendar year, but after excluding the GFC years 2007 and 2008 from the training set.

As financial markets continue to evolve with the rise of AI and big data, the role of ML in asset pricing will only grow. This paper serves as a crucial step in demonstrating how cutting-edge technology can unlock new insights and drive superior investment performance in the real estate sector.

As financial markets continue to evolve with the rise of AI and big data, the role of ML in asset pricing will only grow. This paper serves as a crucial step in demonstrating how cutting-edge technology can unlock new insights and drive superior investment performance in the real estate sector.

Implications for Investors and Researchers

This study highlights the immense potential of ML in empirical asset pricing for REITs. By leveraging ML models, investors can improve risk management, optimize portfolios, and make more informed real estate investment decisions. Additionally, the research underscores the need for further exploration into ML applications in real estate finance, particularly in understanding the fundamental drivers of REIT predictability.

Machine Learning and AI are disrupting real estate markets and investments. Cambridge’s real estate research centre doesn’t just watch from the sidelines but is analysing how this revolution is re-shaping real estate. Watch this space.

Machine Learning and AI are disrupting real estate markets and investments. Cambridge’s real estate research centre doesn’t just watch from the sidelines but is analysing how this revolution is re-shaping real estate. Watch this space.